Is Your Brand Ready For Gen Z?

The Pull agency provides brand development and emerging tech expertise to health & beauty clients. We recently conducted research into consumer attitudes to health and beauty with a particular focus on Generation Z. This was presented to an industry audience in Feb 2020 and discussed by a panel with representatives from Schwarzkopf, Marks & Spencer, Microsoft and a skincare start-up – Vice Reversa.

Pull also conducted street interviews with Gen Z in shopping locations in the south of England.

So this summary combines findings from a survey of over 1,200 UK consumers, street interviews and an expert panel.

Everything’s changed, nothing’s changed.

Generation Z is now the largest generation on the planet and 33% of the UK population. Marketers are often keen to portray Gen Z as newly minted. A new form of human who see the world differently. At Pull we’re not quite so sure. Homo Sapiens has taken a million or so years of development to reach this point. Having taken that long to develop the algorithms that drive our instincts and emotional responses, it’s unlikely that one generation is going to behave completely differently to all the previous ones.

Humans don’t change that quickly, but context can. Far more than any other generation, Gen Z’s world is one where most of the things that matter in their lives are delivered up via a screen in their pocket – their social life, their entertainment, all the information they need. On the other hand, sometimes forgotten are the experiences and milestones that shaped previous generations that they haven’t experienced: Not feeling truly liberated until you passed your driving test, listening to the B side of a record, writing a letter to a friend, making a call from a phone box, picking up holiday photos from the chemist, returning from a holiday to discover some major news event (OK Baby Boomer confessions here).

So perhaps we shouldn’t be surprised that when living in a largely digital world, Gen Z look to the physical world for escape, with time spent shopping with friends seen as a sought after experience.

So let’s looks at how Gen Z think and behave in the world of health and beauty.

Gen Z what matters most – looking well or feeling well?

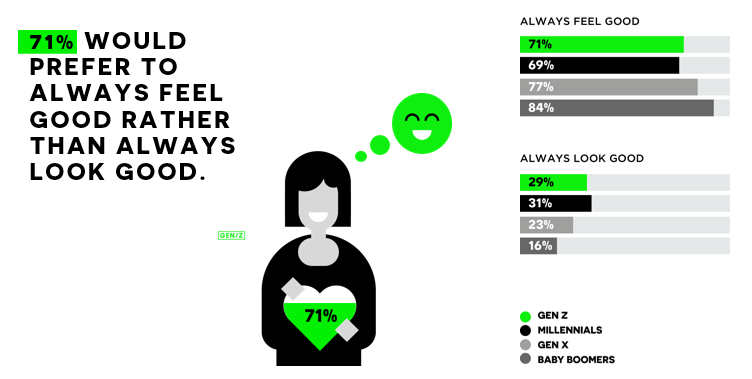

Often viewed as superficial – the “Instagram generation” and “anti-social” for living life behind a screen - our research showed that seven out of ten would actually prefer to always feel good than always look good (by contrast, Millennials are the ones who most want to look good rather than feel good). You can see from the chart below that Gen Z actually bucked the trend – which was clear across the other generations – to be more inclined to feeling good than looking good as they got older.

Gen Z – are they obsessed with celebrities?

The short answer is probably ‘No’.

- but, this is highest of all generations with 11% of millennials selecting celebrities, falling to only 4% for Baby Boomers. But this is well below the influence that social media influencers and friends have.

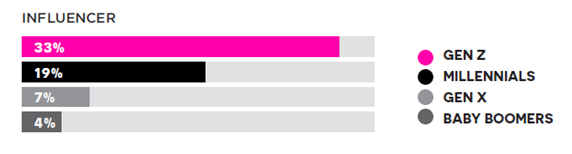

It seems that where Gen Z stand out from other generations is on influencers. Influencers are doing what they are supposed to with Gen Z – with 33% seeing them as their biggest influence when it comes to health and beauty products, slightly ahead of their own friends.

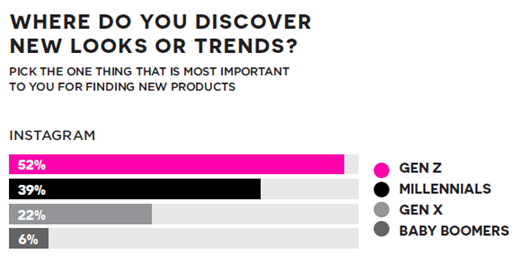

Apparently tired of celebrities, Gen Z are nevertheless discovering new looks or trends online. Often seen as the ‘Instagram Generation’ our research confirmed that perspective with 52% citing Instagram as their key source and 25% citing YouTube.

We also found that Gen Z relied more on reviews than any other generation. What we don’t know is what drives it. However, being less settled in their brand choices, relying more on online information and having the time to be diligent in purchases may all contribute to this. Reliance on reviews declined with age with only 56% Baby Boomers saying that reviews influence their purchases.

Gen Z – do they buy everything online?

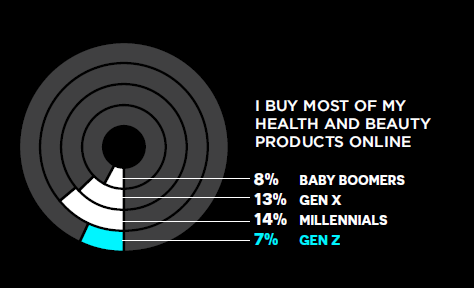

No. In fact, they are even less likely than Baby Boomers to buy ‘most of my health & beauty products online’.

Gen Z are in fact as likely as Baby Boomers to buy in a chemist, and more likely than any other generation to buy from a health and beauty specialist or department store. So much for the idea that Gen Z have given up physical shopping. It seems quite likely that Gen Z who are such big consumers of digital media in the forms of entertainment, still see physical shopping for health and beauty as a strong preference. The one place they’re unlikely to buy health and beauty though is the supermarket, being half as likely even as Millennials to buy there.

As Pull event panel member Kirsty Anderson from Marks & Spencer pointed out, “physical shopping can be an immersive day out, and you can still do things in-store that you can’t do online – like smell and touch”. So retailers have to ensure shopping is also entertainment. While there are endless tales of High street woe, The London Westfield centres recorded 5% year-on-year sales increases in 2019.

Gen Z – have they turned their back on big brands in favour of smaller niche ones with cleaner credentials?

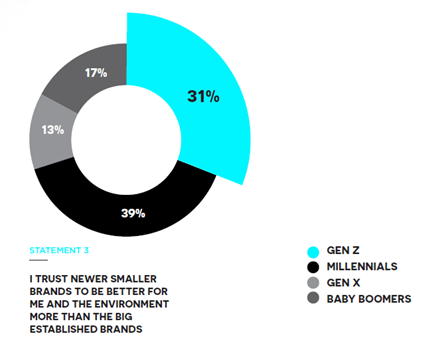

Are Gen Z rejecting established brands for failing to meet their exacting demands for being planet friendly? Not exactly it would seem. Our survey showed that belief in smaller brands that ‘promise something better’ is significantly stronger among Millennials than Gen Z. Millennials are 30% more likely to agree with the statement that they ‘trust newer smaller brands to be better for me and the environment than the big established brands’. Could this be something to do with their relative purchasing habits? Millennials are twice as likely to buy most of their health and beauty products online as Gen Z. And we know from previous research that the established health and beauty brands have a much bigger share of offline sales than they do online.

Looking further into this our research showed little or no difference between the generations when it came to attitudes to brands that make animal-testing related claims, or claims about natural ingredients, environmental friendliness or use of plastic. The only areas where there was a slight difference was with brands linked to a good cause, which Gen Z ranked of slightly higher importance than the other generations (who all ranked it the same). The opposite was true of ‘locally sourced or made’, in this case the factor was ranked slightly lower than by Gen Z than all other generations.

When you consider that there is also no evidence that ranking good causes as important actually translates into purchase intent, this rather undermines the myth that Gen Z are the leading flag-bearers of sustainability. After Baby Boomers, Gen Z come over as arguably the most conservative health and beauty shoppers when combining their love of offline, confidence in big brands and attitudes to ‘clean beauty’ issues.

Gen Z – what can we learn from their use of tech?

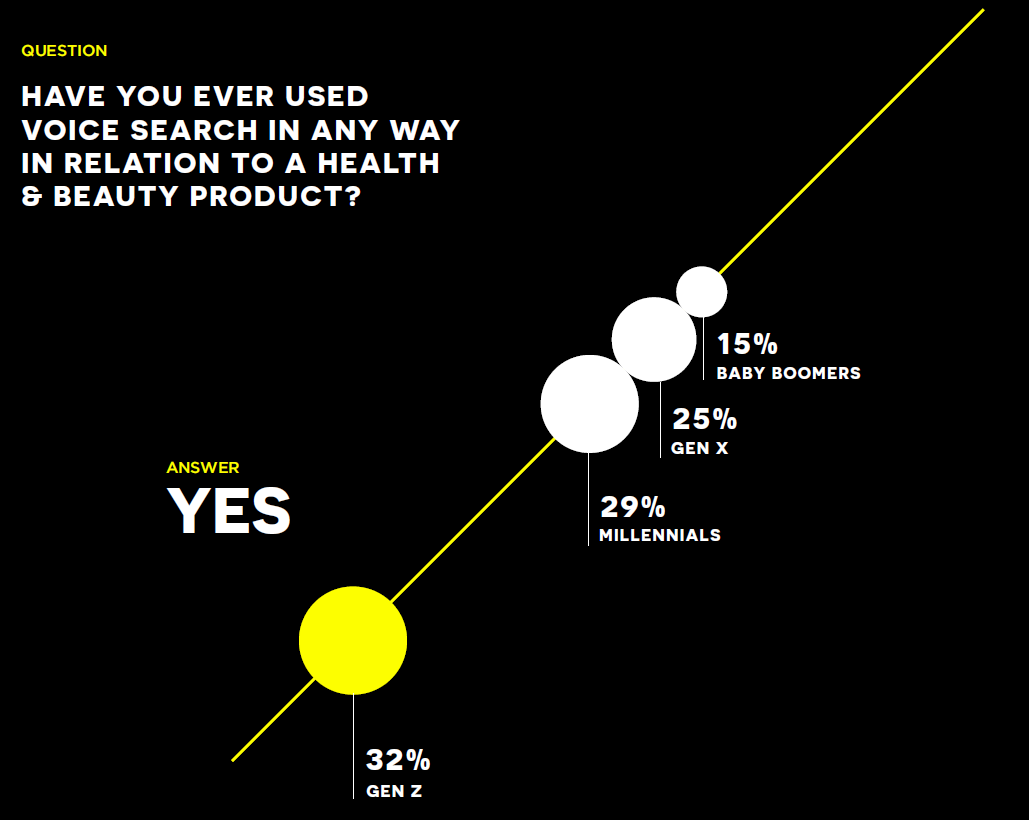

Before they can even write, small children bombard their parents with questions. Is it any wonder that exasperated parents now delegate the duty of reply to voice assistants? Older generations type questions for Google into their phones and computers even when they could just ask. Why do they do this? Habit. It’s what they had to do for 20 formative years. For Gen Z however, why on earth would you type when you can just ask?So its no surprise that Gen Z are ahead of the other generations when it comes to using voice search.

However, our street interviews with twenty-somethings suggested that even for them, the typing habit for search is well engrained.

But the early signs are there. Whereas not a single Baby Boomer in our survey said that they used voice search in the car, this rose steadily with younger generations with 6% of Gen Z saying they used voice search in the car. We would anticipate that the younger members of Gen Z, weaned off questioning their parents to voice assistants will never type a query into a search engine that they can simply ask. Queue shameless twenty-somethings of the near future having a conversation with Google or Alexa on the street, in the train and at work.

And as one of our tech panellists pointed out, thanks to AI this technology has already begun moving away from ‘single question-single response’ to a more natural, dialogue-based approach.

Finally, our research showed that Gen Z had the highest expectations regarding the role of augmented or virtual reality in experiencing health and beauty brands among the generations. With 32% saying that they had already used AR technology in relation to try or understand health and beauty brands better.

Conclusions for health & beauty brands targeting Gen Z

- For all brands, good Instagram and YouTube presence is a must.

- For big brands: Keep calm and carry on. Gen Z haven’t dismissed you. Leverage relationships with the high street chemists, but consider that Gen Z see shopping as sociable and entertainment. What can you do with your brand in-store to captivate and educate Gen Z?

- For smaller brands: Find the right micro-influencers and get good reviews as soon as you can. Although direct sales may be the route for you, don’t ignore the benefit of a Boots or Superdrug listing if you are specifically targeting Gen Z.

- Consider how you can use AR or VR to help people evaluate your brand and the choices within it.

- Don’t assume that a long checklist of environmental claims will appeal especially to Gen Z, but being obviously associated with a good cause may help.

- Create your first voice search strategy now. Good SEO is a long game and is heavily dependent on good quality content. So make sure you have it in place. It will be much easier to tweak your content based on a good SERP than try improve your ranking from a long way back later.

Conclusions for health & beauty retailers about Gen Z

- Think ‘Phyigital’. Gen Z want immersive, interactive shopping experiences which they can enjoy with their friends. So take advantage of your high street presence which might mean experience is more important than stock. If they have a good experience in-store, they can buy from you online while in-store.

So as one of our panellists pointed out, although the research provides some fascinating insights about the differences about Gen Z and health and beauty, what’s surprising is how similar some of the perspectives are across the generations. This was especially evident in the area of environmental impact of health and beauty products.

Everything’s changed, nothing’s changed

As ever, what’s important is to understand what has changed and what hasn’t. (Probably) like you, young people like spending time with friends, going shopping and care about the world around them. However, they are early adopters of new technology so are influenced by new media channels, will increasingly talk to their devices rather than type in to them, and use apps with AR and VR to explore brand options. Good brand strategists will act on this understanding of what has changed and what hasn’t.Posted 15 June 2020 by Chris Bullick