What is the future of beauty?

‘Everything’s changed, nothing’s changed’ as we are fond of saying at Pull.

The health beauty and wellness market boasts some quite impressive stats. Arguably one of the oldest industries, the earliest written reference to cosmetics is probably in the Old Testament which refers to Jezebel painting her eyelids in about 1,000BC.

By today, the combined markets of health beauty and wellness amount to an estimated value of $4.3 Trillion. (If you struggle with what a trillion is as I do –then that’s two and a half thousand billion dollars.) Looking good and feeling good aren’t going anywhere anytime soon.

Working with a range of clients from global haircare giant Schwarzkopf Professional to dynamic start-up True Skincare, and leading probiotic supplement Symprove, Pull gets some amazing insights into how these markets are developing. We are also expected to deliver some insights.

So, what are the key trends in the health, beauty and wellness marketplaces and where is this category headed? Even if you are not in the health and beauty business you might do well to take note. This is arguably the most dynamic and fast-moving category in FMCG, so where health and beauty brands go today, other slower moving categories will go tomorrow.

1. Ethics and ‘natural’ are big and fragmenting into sub-interests

According to Nielsen, there are now four sub-categories of ethical interest: ‘Natural’, ‘Cruelty free’, ‘Vegan’ and ‘Free from’. All have shown growth in the last three years – and at the expense of traditional brands that aren’t making similar claims. Share of shelf-space in store has also increased for these brands which must mean that they are offering category value growth to retailers and better margins.

On the other hand, consumers are increasingly looking for proof and authentication. Hence the growing set of endorsements like the cruelty free bunny logo.

2. Products are proliferating to suit a diverse global base

Burgeoning middle-class populations in S. America, India & China are increasing demands for products to suit a wider range of skin colours, hair types and colours. People are looking for products that offer a more individually relevant or personalised experience. In the US alone the number of unique foundation colours sold has grown from 500 to 700 in the last 5 years.

3. Product categories are morphing

One category that has experienced continual slight decline is sunscreen. Consumers are always on the look-out for smart combination solutions. So, they have embraced skincare products that include sunscreen. With a daily sun-care regime that includes a sunscreen ingredient, consumers are forgetting about that bottle of sunscreen. This may be a mistake however, as a lot of beauty products don’t have the full SPF protection which sun cream boasts.

4. Category business is moving online faster than any other FMCG category

In the US 30% of health & beauty sales are now conducted online. This appears to have opened up the market to smaller, new and start-up brands in a dramatic way.

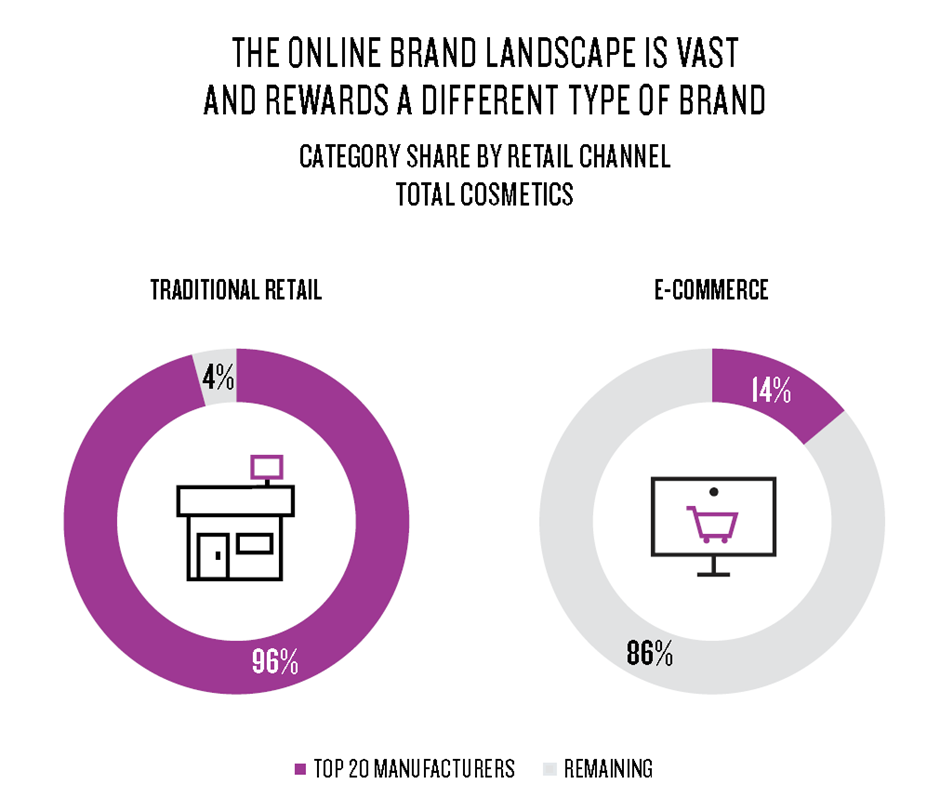

What we see is the traditional top 20 manufacturers dominating what we in the UK would call the High Street with a 96% share of sales instore, but only enjoying 14% of the online market. Clearly, agile new brands are attacking the big brands’ heartland through the backdoor (or direct through the consumers front door) of online. Consumers are more open to buying directly from smaller brands online with reliance on the big retailers declining.

Source: Nielsen Source Retail Measurement Services, 2017

It’s perhaps not surprising therefore to see a business like Henkel buying Los Angeles-based eSalon who create personalised made-to-order DIY hair colour direct to homes. eSalon has already shipped 6 million orders and over 165,000 unique colour combinations.

5. Social Media has more influence than in any other FMCG category

All consumers, but especially younger consumers, actively look to social media for inspiration, and especially to the more visual social media of Instagram and YouTube. Social platforms are pivotal to new brand success and signing up an authentic but well known influencer can give upstart brands a leg-up that traditionally only mass-market media could achieve.

6. New technologies are facilitating online purchases

Augmented and virtual reality are letting consumers ‘try’ cosmetics before they buy online. One of the first companies to do this was ModiFace who like eSalon, being snapped up by Henkel, Modiface was recently bought by L’Oreal.

The whole marketplace for augmented reality in beauty is a fast-moving smorgasbord of alliances between tech brands and retailers covering cosmetics, skincare and even nails.

7. Voice search and assistants will be the next major inflexion in the way health and beauty products are bought

If you think voice is slow to be a factor (to be honest we did until we looked harder) think again. In 2019 112m people in the US are estimated to be using a voice assistant at least monthly – that’s a third of the total population. We think voice is a bit of a sleeper. People report frustrations with voice assistants, but persist and expect them to get better.

Underestimating voice search could be a big mistake when you see how naturally children and Gen Z take to them. What could be more natural than speech? What is easier, writing your instructions or speaking them? All older generations (and that now includes millennials) have grown up typing search queries; first into a computer and then into our phones. We expect 10 or more visual results from a typed search – more if it is an item appearing on Google shopping. Voice will yield a much smaller – but with the help of new algorithms, machine learning and AI – more accurate set of answers. This will change the game for advertisers and brand owners. It used to be that you needed to be on page one of Google or you were dead. With voice search you will need to be number one.

Optimising for voice search is likely to be a new and interesting game, and rather than being about meta-data and Google page-score, will probably be more about being the best answer to the question that your voice assistant has interpreted for you, based on everything else it knows about you.

We are excited by the future of the health and beauty category, but feel that there are questions that we need answers to. That way we can provide our clients with insights and answers to keep them ahead of the game.

Hence our Future of Beauty Survey. Pull has commissioned substantial quantitative research to answer some of the questions thrown up by the trends we see in health and beauty today. In particular, we want to look at how attitudes and habits across generations change in regards to discovering & purchasing health and beauty products.

We will be asking some of the following questions:

- What channels do they use to discover new looks and trends?

- Where do they discover new brands?

- How open are they to new brands and products?

- Will they continue to shop on the high street?

- Which ethical interests impact your brand purchases?

- How much do people care about product personalisation?

- Are people really using voice assistants to search for products and information in this category?

- What are they asking about and where are they when they use voice assistants.

We will be presenting our findings to Pull friends and clients at a specially organised event later in the year. Watch this space and check in on our events page for more on this!

Posted 3 September 2019 by Chris Bullick