I KNOW WHAT EVERY WOMAN WANTS (AND MEN TOO.. )

What consumer research in the health and beauty category has taught me about human behaviour.

I sometimes feel like Mel Gibson’s character in the film ‘What Women Want’.

If you haven’t seen it, do. It’s funny and charming and not what you might expect. In it, Mel Gibson’s character works at an ad agency and accidentally acquires a superpower: He can hear what women are thinking.

If you had asked me about 5 years ago, as we began to focus in on health and beauty, what women wanted from the products they bought, I think I would unequivocally have said: “To look beautiful. To be more attractive”. After polling tens of thousands of consumers (more women than men), and running focus groups with dozens, I have finally determined what women actually want: To feel better about themselves. And men? To feel better about themselves. It appears to be a universal part of the human condition and the key driver in using health and beauty products. It is true of both sexes, all gender and sexual orientations, and all ethnicities. Perhaps you think this is obvious, and colleagues (much to their frustration) have regularly pointed this out to me. But I like to think of myself as an evidence-based marketer. I had to see the evidence!

This is why I think even the beauty side of health and beauty industry can truly feel that their mission is more about wellbeing than appearance. It is true across the health and beauty categories as well. From supplements through non-surgical aesthetic treatments, to menopause therapeutics to skincare and cosmetics. Our research in all of these areas always uncovers this fundamental truth: Doing something about your health, wellbeing or appearance is good for you of itself.

The physical outcome is less important than how it makes you feel. That’s not to say that attractiveness isn’t part of what can drive buying in some of these categories. But not everyone is in the mating game. The market for health and beauty products and treatments reaches well beyond those that are.

So what has research into the attitudes of health and beauty customers taught me that a lifetime of observation hadn’t? These are the things that stand out for me:

SUPPLEMENTS & WELLNESS

- Increasingly people are taking steps to take care of their health in a preventative way. In all our research into attitudes to probiotics and natural remedies, it seems there are two clear groups of customers: The diagnosed-ill seeking a non-pharmaceutical remedy, and the well who want to take care of - for instance - their gut health.

- Both groups are facing an important dilemma: People believe pharmaceutical solutions work, but can be dangerous, and that natural solutions are safe but don’t work. They are looking for the most natural solution available supported by scientific proof of efficacy. Brands that can deliver here are going to do well.

- Close to the majority of older Brits take supplements. They are not health-obsessed junkies. Many are in good health, but are well-informed and know what they should be doing to maintain it.

BRANDS & SUSTAINABILITY

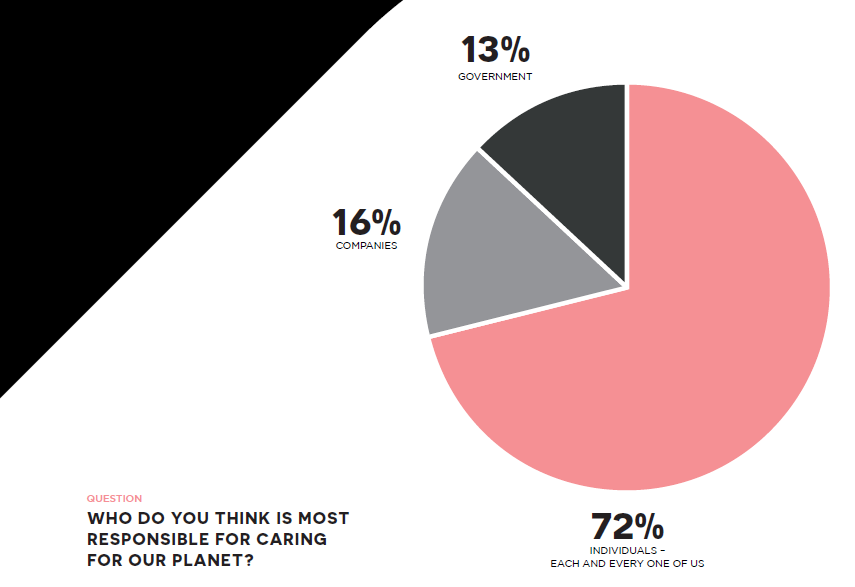

- Consumers worry much more about practical considerations like plastic packaging and waste than they do about hypothetical concerns like ‘the climate crisis’.

- They feel they are ultimately responsible for the environment. So they want the brands they use to respect it themselves and help them as brand users to do as little harm as possible.

- 94% are suspicious that brands are overplaying their sustainability credentials and are much more interested in what brands do to protect the environment than what they say about it.

- Nevertheless, our research and that of others consistently shows that when it comes to purchase motivation, sustainability consistently comes 4th or lower out-ranked by: Results, affordability and quality.

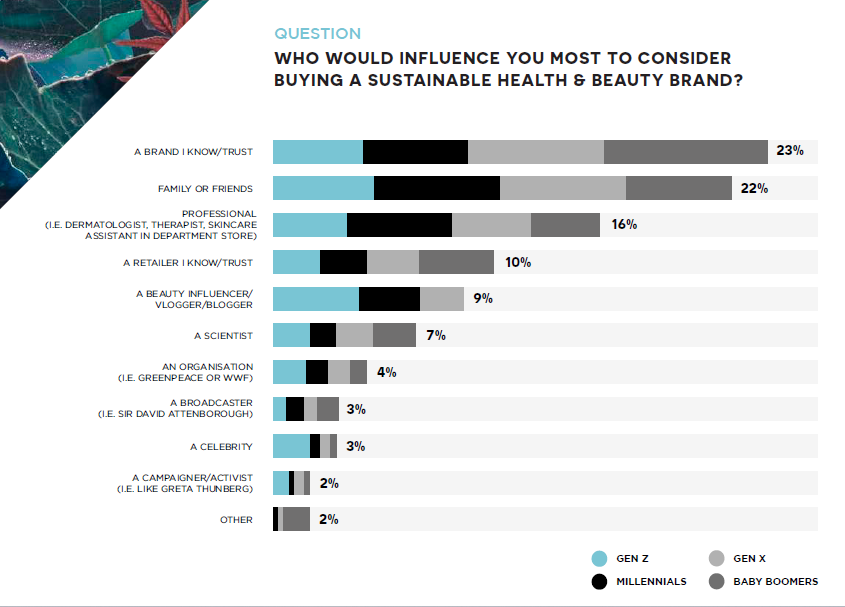

- Only 2% of consumers consider that they are influenced by campaigners like Greta Thunberg and David Attenborough.

MENOPAUSE

- Is arguably the last taboo. This varies by culture. Although there are positive signs of this changing – at lease in industrialised societies – it is still a subject rarely talked about.

- This may account for a lack of knowledge on the subject. Even a significant percentage of women describe their knowledge as sketchy. Men know even less. Normalising talking about it as a life stage (like people see puberty for instance) would make life easier. Brands who can do this will do well.

- Women fall into three groups with reference to the menopause. Those who ‘sail through’ without help, those who want a pharmaceutical therapeutic (HRT) and those who would prefer to find an effective non-pharma or more natural remedy (see Supplements & Wellness above).

BODY POSITIVITY

- People want brands to be realistic about body shapes in ads. They dislike brands using improbably slim models, but also dislike the celebration of obesity.

- Brands that handle this well will make people feel good about themselves which is probably the purpose of their brand – so it is worth paying attention to and getting the balance right. (When Dove first did this nearly 20 years ago, it was a shock at the time and therefore quite a radical move, but has served them very well.)

- 70% of the British public had or are considering non-surgical aesthetic treatment. Only 15% have never had a treatment and wouldn’t consider it. The key motivation is healthier skin followed by deferring the signs of age.

- The more likely you are to have a treatment, the more likely you are to have another.

- Just as many men want to defy the signs of age as women. Men are very focused on hair loss and put a very high value on preventing it or restoring it.

GENERATIONAL COHORTS

- Generally marketers read too much into these. This is well indicated by marketers obsession with Gen Z. Part of this can be put down to a natural fixation with shiny new things. In fact Group Cohesion within generations is often less than it is for instance by profession (marketing has the highest conformity of all professions!).

- However, generational attitudes do change in health and beauty more than elsewhere. This is easy to understand. As we get older our experience with what works and what doesn’t increases. Our needs and attitudes change as we age.

- Note ‘as we age’. Gen Z are often held up as paragons of a new virtue - for instance because of their claimed support for progressive causes. However, this is not (as is regularly suggested by those who ought to know better) because they have a better moral compass, it’s because they are young. The young have always been idealistic but also naïve.

- But there are differences which marketers should take note of. The starkest to us at Pull is shopping preferences. It’s not so long ago that marketers were marvelling at how much the young bought online. This has almost reversed. Whereas we found that online shoppers - for supplements for instance - actually bought more online the older they were (not really that surprising when you think about it), Gen Z love going shopping. For them it is often a social experience. Something to do on a Saturday morning with your friends, where seeing and trying new things is part of the fun. This explains the otherwise somewhat counter-intuitive success of Sephora.

I have to confess that as someone who has never been to a spa in my life, and would see one as about as appealing as a visit to the dentist; and as one of those 15% who hasn’t and wouldn’t consider non-surgical aesthetic treatment, and whose annual ‘grooming’ budget is about £100 (6 visits to the barber - £72, and the rest for razors, shaving foam and shampoo) much of this came as a surprise to me.

Fortunately, while I am not a big category buyer, I have always been fascinated by human behaviour. There is so much to be learnt and you never stop learning.

You can download all of our 3 consumer research reports here.

Posted 19 January 2024 by Chris Bullick