In our last article we talked about how to hack market research if you were a smaller brand.

The subject of research for smaller brands was also discussed at a Brand Breakfast round table that Pull ran recently in London (a great meeting of marketing minds for whom we produced this very well-received booklet ‘Why the need for sales today could be undermining the future of your brand’.)

Having agreed at the meeting that the definition of smaller brand that we use for this series: that ‘smaller’ isn’t necessarily that small - £100m turnover - we did a quick around the table poll of how many of the brands represented there (10) had done consumer research. The brands included at least one greater-than £100m brand. One hand went up – and it wasn’t for that >£100m brand. . .

As we pointed out in the last article, many of Pull’s brand development clients are research virgins. In discussing how we could progress their brand it becomes clear that there are fundamental questions about how consumers think, feel about and shop their category that very often clients can only speculate about. (Slightly more frustrating and in line with the gist of our last article, sometimes research has been done – that answers all the wrong questions – and none of the fundamental ones we and our client really want answers to.)

Pull’s brand development projects often create new brand identities, progress existing ones, generate creative concepts or develop campaigns. The quality of outcomes for these projects are heavily dependent on key questions about the motivations and habits of the consumers we are targeting.

Perhaps it was because they were often first-time researchers that every one of these projects led to a significant surprise.

In our experience the first piece of research you do for your brand is the most valuable you will do.

So what we are going to tell in this article is some of the stories of important learning, insights and breakthroughs our clients experienced that informed their brand strategies, and what the impact was.

In each of these stories consumer research and the development of a Brand Blueprint™ combined to effect transformation for the brand in question. And in one case a prestigious award for brand transformation.

Client Stories

Gocycle

Who are Gocycle?

Gocycle is a British-based worldwide leader in e-bikes. Gocycle was the brainchild of ex McLaren car design-engineer Richard Thorpe, who was determined to reinvent the bicycle. Highly acclaimed, and winner of multiple magazine ‘shoot-outs’, Gocycle is now seen as a design icon.

Gocycle approached Pull in 2017 with a view to getting help doing better informed marketing. We conducted consumer research and developed a Brand Blueprint™

Overview

In summary, the client gained an accurate picture of who worldwide had bought their brand for the first time, and as a result changed the brand positioning to attract more of them.

Surprise?

The profile and motivations of buyers was not what the brand owner thought it was.

Insights

Action taken

Gocycle had been positioned under the tagline ‘Performance Commuting’.

It was targeted at bicycle commuters who were thinking of switching to electric propulsion.

As a direct outcome of our research and Blueprint, Gocycle was re-positioned ‘as if it was a luxury product’. We didn’t want to actually position the brand exactly as you would a high-end watch or a Bentley. However, we borrowed some of the techniques used by those brands. This meant making the product the hero, using less lifestyle imagery and emphasising its pedigree and performance over pricing.

High profile Gocycle owners like Cristiano Ronaldo, Chris Evans and Cara Delevingne helped, and we were able to widely share images of them on their bikes on social media. Our view was that as the price of e-bikes came down – which they did for a while – and the category was democratised, the brand would be democratised with it. This has happened.

However, there was another dimension to the brand. Gocycle was developed with a higher purpose in mind – which was to get people out of their cars and onto bikes. The Blueprint defined the brand mission which had driven founder Richard: “The world deserved a better bike”.

So while the heroic product shot was used for the website homepage, the brand mission was incorporated in a complimentary way.

Results:

-

Prestige: With its highly distinct outline and unique, identical front and rear wheels, Gocycle has become a design icon seemingly defying the old adages that “You can’t improve the bicycle” or “reinvent the wheel”.

-

Growth: Since the re-positioning, Gocycle sales have grown strongly year-on-year.

Here’s the key learning for your brand

Don’t guess who is buying your brand and why. You and everyone in your company will have their own idea of who is. In most cases they will be projecting – “people like me”. And more often that not their agency will be encouraging them. Agencies are largely populated by ‘right-thinking’ urban Gen Z-ers. Who do they want to market to? Same. We have yet to do a piece of consumer research that demonstrates that the average age of a client’s actual buyer is not at least ten years older than they thought (hoped for).

Symprove

Overview

Who are Symprove?

Symprove is a liquid probiotic proven to deliver more live beneficial bacteria into the gut than any other product.

In summary, the client learnt what had convinced consumers to try their brand for the first time. Secondly, that the core set of product buyers purchasing the product as treatment for a specific condition (IBS), were dwarfed by a far larger available market who saw it as a product for sustaining good gut health.

Surprise?

That there were far more people interested in gut health who would buy Symprove than there were people suffering from IBS – Symprove’s existing buyers.

Research: Number of Qual & Quant Surveys – Customers and consumers suffering from IBS and those interested in gut health

Key things learnt through Qual & Quant research:

-

Despite heavy online research of their own, the average IBS sufferer didn’t try the brand until they got a personal recommendation from a trusted and authoritative person.

-

There were 1.6m consumers who suffered from IBS in the UK - but there were 25m people in Britain who were interested in maintaining good gut health.

Action taken

The brand underwent a major refresh. Essentially it was re-positioned from ‘For the sick’ to a brand that would also appeal to the well – those interested in maintaining good gut health. This involved creating a more positive, upbeat brand identity. A creative concept: ‘Inside Out Thinking’ was developed, along with new packaging, and new conversion-optimised website. You can read the full story here

Results

Following the launch of the new website, website revenue increased by 44% year-on -year, helping drive a 54% increase in sales. Effectively communicating Symprove’s new positioning on the website also saw bounce rates drop by 12% year on year.

Here’s the key learning for your brand

Don’t let history and previous practice dictate who your target audience is. And don’t target too narrow a niche. Take a look at the big picture and find out what lies outside your niche of apparently very needy customers. In Symprove’s case it was clear that it actually took a lot to convert that core. But outside of that core was a set of people 15 times greater. It was possible to re-position the brand to appeal equally to both.

GAK

Who are GAK?

GAK are a leading UK online contemporary instrument retailer with a landmark store in Brighton.

Overview

In summary, with the research we were able to create a market map of UK musical instrument retailers based on variables important to consumers, define two significantly different target consumers, refute an hypothesis about the GAK brand personality, and create a compelling new identity.

Surprise?

Pre-research we had developed an hypothesis that Pull would create a new ‘more Punk’ identity for GAK as a deliberate contrast to the ‘Rock ‘n Blues’ persona (developed by The Pull Agency) for fellow music retailer Andertons. In quant and qual research, customers firmly rejected the ‘punk’ identity idea.

Research: Qual & Quant Surveys – Customers and staff

Key things learnt through Qual & Quant research:

-

Two clear consumer segments were identified: 1. An older, typically male guitar-playing ‘Rocker’. 2. A younger, not so male-biased ‘bedroom musician’ who used tech to collaborate and create music online. This group grew strongly during the Covid response.

-

The ‘more Punk’ brand personality was strongly rejected by existing customers, who wanted the brand to be ‘more Brighton’ and the online store reflect the iconic physical store destination.

-

By cross-relating consumer survey research with Google Analytics and purchase finance data, we were also able to establish that the website viewership and purchasing audience were far less male-orientated and younger than those who volunteered for quant and qual research. A good lesson in that being self-selecting, these samples can have significant bias.

Actions taken

A vivid new identity was developed for GAK to bring to life the creative concept of the ‘Music Emporium Brighton’. This feel was bought to life via a series of bespoke Kaleidoscope artworks that hark back to the vibrant attractions on Brighton Pier, but also suggest a blend of contemporary sounds and instruments.

Results

The new designs came at a sensitive time as GAK were negotiating an investment from Risk Capital Partners run by well-known entrepreneur and restaurant chain builder Luke Johnson. The investment was spurred on by the re-design which super-impressed potential investors – a deal was completed and Luke Johnson is now chairman of GAK.

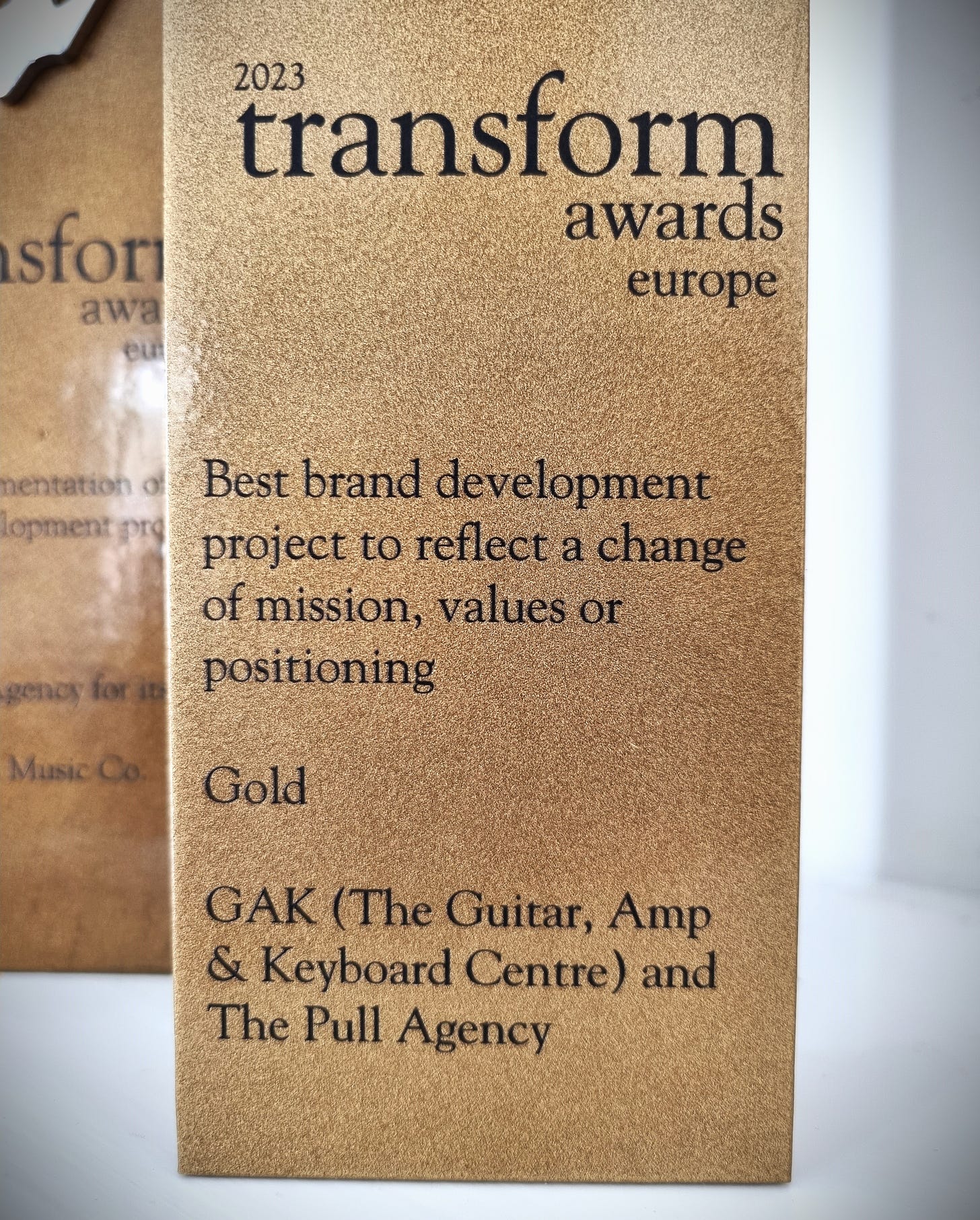

(The project also earned a Gold award from Transform magazine for “Best brand development project to reflect a change of mission, values or positioning”.)

Read the full story here

Here’s the key learning for your brand

Never, ever, ever, imagine a brand persona out of the air: “If this brand was an animal it would be an Aardvark”. (Or those crazy ‘pen portrait’ target personas based on nothing but supposition- “Jemima, our target consumer is a savvy 20-something who does yoga in her spare time, has a cat, buys her lunch at Pret and is a big Taylor Swift fan”.) Knowing what you are selling doesn’t mean you know who is buying. Find out and separate those buyers out into a max of three target groups who share a similar outlook to things that matter to buyers in your category. Some of these groups might actually be substantially different from each other.

Summary

Despite turning over in some cases tens of £millions, none of these businesses had conducted any market research before talking to The Pull Agency. In each case it is clear that if we had acted – on consumer targeting, positioning or band identity – without consumer research we would have done it on internally generated and incorrect assumptions. All of these brand development projects were successful because they were based on powerful insights gained by polling and talking to consumers (as well as staff).

But the research met all the criteria we talked about in our previous article How to do Consumer Research on a Shoestring:

-

Find out everything you can first without the expense of formal research.

-

Agree the small number of killer questions the answers to which will allow you to progress your brand.

-

Create a tight research brief and agree with all.

-

Research only the things you really need to know about. Leave out the ‘it would be nice to. . .’

Posted 24 May 2023 by Chris Bullick